The blockchain technology that is changing how we live is evolving along with the world around us. Virtual reality is one of the most significant pieces of the technology that might have a tremendous influence on the world we are living in.

The potential of the metaverse is so significant that many believe people’s communication behavior is likely to change and take place in the metaverse in the future. This is the reason why so many metaverse venture capital companies have been investing millions of dollars in the metaverse recently.

What are the largest global venture capital firms for the metaverse? Let’s discover the list of the top 5 companies picked by DarePlay.

Table of Contents

What is metaverse?

The word “metaverse” refers to a combination of virtual reality, which is characterized by consistent virtual worlds that remain operational and augmented reality, which combines elements of the digital and physical worlds. Creating virtual worlds in cyberspace as an alternate reality is the core idea behind metaverse technology.

To be specific, metaverse enables real-time interactions and experiences amongst individuals who are physically separated from one another via electronic devices connected to the internet such as a headset or a smartphone. This means that if you are on remote work, you can still discuss and interact online with your colleagues just as you would in real life.

A metaverse may facilitate the movement of inventories, virtual identities, and avatars that are typically tied to a single platform to other platforms. It may also refer to a digital economy in which anyone can access, purchase, and trade items.

“Ready One Player” film is a perfect example of the so-called “metaverse”. There are many worlds that can be explored by just accessing portals. Moreover, it has its own economics as players have to purchase gasoline to race or to engage in combat, they must pay for gears. One interesting thing is that players have different nicknames with avatars that don’t always resemble how they really look in real life.

In September, the K-pop girl group Blackpink won the “Best Metaverse Performance” awards for their virtual concert, “The Virtual” at the VMAS 2022, which they collaborated with the famous mobile survival game PUBG. This could only be the beginning of us getting a taste of the boundless alternate reality where people not only attend concerts of internet celebrities such as Justin Bieber, Snoop Dogg, etc. but also shop, play games, go to school, and interact in social virtual worlds.

What is a metaverse venture capital?

The term “metaverse venture capital” (or metaverse VC) refers to a type of private equity funded by venture capitalists or angel investors for the development and adoption of the metaverse. In other words, businesses having long-term growth potential in the metaverse fields and are in need of capital are likely to be the target of metaverse venture capital.

According to a report by McKinsey, the metaverse growth appears to be tremendous as it received $13 billion in venture capital and private equity financing in 2021. In the first half of 2022, the total investment in metaverse is already more than double what it was in all of 2021. The big 4 consulting firm predicts that the value of the metaverse may exceed $5 trillion by the year 2030. This is the reason venture capital is investing a considerable amount of money in the space, as angel investors in the metaverse are looking to profit from the growing market.

Metaverse venture capital may not only support businesses’ financing but also offer businesses, especially startups, a vital source of assistance and consultation. As organizations want to expand in such a new area like the metaverse, having support from industry experts can lead to smarter decisions in business. Additionally, metaverse VC can also benefit startups with a variety of networks, opening to more and more opportunities in partnership in the future.

Metaverse venture capital fund structure

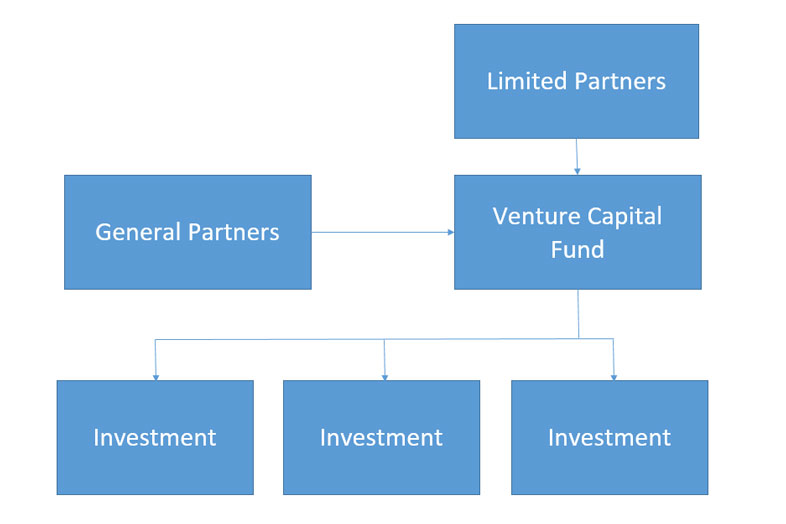

Generally, a metaverse venture capital fund structure is much the same as a conventional venture capital fund. The only difference is that metaverse VCs’s main objective is to invest in the metaverse industry. If a business wants to increase chances of acquiring metaverse venture capital, it must understand its functioning.

A metaverse venture capital fund is often set up as a partnership, where the investors are the limited partners (LPs) and the venture capital company are the general partners (GPs).

- Limited partners are investors who seek to diversify their investments through metaverse VC funds. Limited partners can include insurance firms, pension funds, and wealthy individuals.

- General partners are basically the managers of the venture fund. They are the ones who actively work on projects that they are investing in with the missions to evaluate potential deals and make the final decision regarding how to use the funds effectively. General partners could also work for the businesses as consultants, or board members.

- The general partners and limited partners each receive a portion of the proceeds from the sale of investments made in the different portfolio firms. The general partners, who are also the managers of the private equity funds, often get 20% of the earnings as a performance bonus. The remaining 80% of any gains are distributed equally to the fund’s limited partners who made investments.

- Because limited partners have little involvement in business management, they have to rely on the general partners and venture firms to be specialists at investing.

Top 5 best metaverse venture capital firms

It’s essential to value a metaverse venture capital. This will be a place where businesses, especially startups, focused on the metaverse can rely on for technical, or promotional support. Therefore, DarePlay has established four main criteria to assess the quality of a metaverse venture capital:

- Return on investment: (or ROI) One popular metric used by metaverse venture capital firms to assess a company’s success in the market is return on investment. ROI indicates whether or not a market strategy is successful because the market is all about purchasing items when they are on sale and selling them when the price of tokens has increased. Before making any new investment-related decisions, it is critical for metaverse venture capital to comprehend how current investment is performing and an excellent place to start is with return on investment.

- Operation team: This is very important since the people working on a metaverse VC are what will determine its success (or not). Take into account the following when examining the team: the expertise of the team members; their background and degree of knowledge in the crypto space; and how well-organized the team is. An excellent team will constantly develop strategies that are centered on the future, especially in the metaverse space. The way a startup company operates will frequently determine whether it succeeds or fails.

- VC’s fund and ability to raise capital: A fund manager invests in a number of potential businesses using the metaverse venture capital fund, which are amounts of money collected from a wide range of individual investors, in order to maximize prospective returns. The bigger the metaverse venture fund is, the greater the opportunities for metaverse-focused businesses to succeed in the future.

- Social media engagement: Metaverse venture capital company spreads its information and statistics using a variety of mass media, including television, email, and—most significantly—social media. It is important to comprehend the “organic engagement” a metaverse VC has on social media, and how the venture is doing on the internet. It is because this might help them attract new metaverse investors, establish their credibility, and promote their project in a positive light. Many different platforms, including Twitter, Telegram, or Discord, can be taken into account.

Animoca Brands

Animoca Brands, which was founded in 2014 by tech entrepreneur Yat Siu, is a pioneer in digital entertainment, blockchain, and gamification that is advancing digital property rights and assisting in the creation of the open metaverse.

The metaverse venture capital has more than 380 investments, valued at more than 6 billion dollars as of 30 April 2022, including startups or unicorns such as Axie Infinity, OpenSea, The Sandbox, Harmony, Alien Worlds, and others.

In July 2022, the Hong-Kong VC completed a $75.32 million funding round with participation from Liberty City Ventures, Kingsway Capital, and others. This round follows a $358.8 million funding round in January that was backed by giant venture capital Sequoia China, Winklevoss Capital, ParaFi Capital, and 10T Holdings. Only in this year, more than $443 millions of dollars was raised by this metaverse venture capital to create an open metaverse.

Since the beginning, Animoca Brands has been supporting many crypto unicorns, and one of them is Axie Infinity. In 2019, the venture capital led a $1.5 million investment into Sky Mavis, the famous play-to-earn project’s creator. Despite the Ronin bridge hack crisis in March 2022, Animoca Brands still made further investment in Sky Mavis as a part of a $150 million funding round with other metaverse VCs. Eventually, the ROI as of October 5, 2022, is calculated at about +15,682.6%, with the all-time-high ROI of +205,318.8%. This indicates how wise the metaverse VC was to choose to fund a promising crypto enterprise.

Another popular metaverse project that Animoca Brands is currently investing in is the Ethereum virtual world – The Sandbox (SAND). In fact, The Sandbox is a subsidiary of Animoca Brands that has actively promoted its brand through partnerships and collaborations with organizations as well as celebrity appearances on the metaverse train. The metaverse venture capital, which invested in The Sandbox at a pre-sale price of $0,0036, has paid off as the gaming platform’s return on investment is currently at +23,806.2%, generating significant profits for metaverse investors.

There are many other metaverse projects that Animoca Brands is working on. Recently, the metaverse venture capital firm has partnered with Yuga Labs on the gamified metaverse project called “Otherside”; the immersive 5D metaverse “Wilder World”; or the prominent metaverse “Decentraland”.

On social media, Animoca Brands has been simultaneously receiving thousands of organic interactions from followers on all new media platforms, especially on Twitter. In 2021, the Financial Times listed Animoca Brands as one of the top high growth firms in the Asia-Pacific area.

Hiro Capital

Hiro Capital is a London-based venture capital firm focusing on investing in the future of gamefi creators and metaverse technology. It was first established in 2018 by Ian Livingstone, Cherry Freeman, and Luke Alvarez, and since then, it has grown to be one of the most active investors in the VR/AR sector.

They established a $130 million first metaverse venture capital fund in 2019 called “Hiro Capital I” and a $340 million second fund called “Hiro Capital II” three years later. Hiro Capital has so far invested in 21 Series A and B games and metaverse-based businesses in the UK, EU, and USA including Seattle-based Polyarc, FitXR, an online fitness platform, and the developers of Keen Games and Snowprint.

On the London Stock Exchange, Hiro Metaverse Acquisitions 1, which is the division of Hiro Capital, raised $150 million through an IPO. The VC presently has more than $600 million in assets, which is the entire budget that the three investment funds have raised.

In a statement, Luke Alvarez, managing general partner and also one of the founders of Hiro Capital, said: “In 2022 we are at a pivotal moment in the very early phases of the metaverse, VR, AR, and Web3 – these revolutions will take at least a decade, and much of the creativity and technology innovation will start in games”.

Play Ventures

The next player is Play Ventures, one of the most well-known in the VR industry. Play Ventures has backed more than twenty firms since the company’s founding four years ago, including MetaSoccer, C2X, Blackpool, and Trailblazer.

Many of the employees at Play Ventures have many years of expertise. Henric Surronen, one of the founding partners, has more than 16 years of experience developing mobile games and studios, either as Senior Creative Director at King or as Product Management Director at Digital Chocolate (Helsinki and Barcelona). Since the core members of the metaverse VC have years of experience in auditing at EY and KPMG, they demonstrate their competence when it comes to finance management.

The Singaporean venture capital firm has raised $75 million in total for a new fund called “Play Future Fund” with an aim to invest in a new generation of metaverse entrepreneurs who are creating in the developing intersection of gaming and web3. Community Gaming, ReNFT, and GuildFi are three of the firms in which the corporation has announced the metaverse investments.

Play Ventures has received a lot of interest and is supported by important entrepreneurs and individual investors from the gaming and blockchain industries, as well as institutional investors and renowned investors in international gaming firms. The company’s total assets under management have already surpassed $300 million.

In March 2022, Play Ventures successfully invested $25 million in the private token sale of the blockchain gaming platform C2X with the participation of a large group of investors, led by FTX Ventures, Jump Crypto, and Animoca Brands. With an estimated return on investment of +663.1%, the project’s future seems to be bright. This may mark another profitable investment of the metaverse venture capital that focuses on gaming and the metaverse.

The metaverse venture capital is not extremely active on social media due to the few updates on its Twitter and Facebook accounts, as well as its official website. However, the metaverse VC’s role as a pioneer in creating the metaverse ecosystem is undeniable.

FOV Ventures

FOV Ventures is a metaverse venture capital founded in 2022 with a focus on early-stage metaverse businesses. The two founding partners, Dave Haynes and Petri Rajahalme, express their special interest in the Metaverse-related areas of identity, avatars, commerce, entertainment and social, the future of work, and creator tools and infrastructure.

The duo has incredible backgrounds: Dave Haynes, who became well-known via his work with HTC, and Petri Rajahalme, a former managing director of Nordic XR Startups (NXS), where he supervised eight investments in XR businesses in the Nordic region.

Even though it has only been operating for barely less than a year, this VC has succeeded raising funds to invest in the metaverse-focused firms. According to the company’s announcement in March 2022, the first $18.1 million of its initial fund has been raised.

The recently established venture capital business plans to invest in metaverse firms situated in Europe in their early stages. To be specific, The FOV Ventures’ founding partners intend to invest $274,500 to $550,000 through the metaverse venture capital fund in up to 25 pre-seed and seed-stage businesses that aim to build the next wave of Metaverse.

While raising the metaverse fund, the duo made more investments in firms connected to the Metaverse, including ReadyPlayerMe, the Metaverse’s cross-game avatar platform, and The Dematerialised, a Web3 marketplace for verified virtual products.

Shima Capital

Shima Capital is a global early-stage venture capital firm that invests in innovative blockchain startups. The VC was founded in 2021 by Yida Gao, who was featured on Forbes’ 30 Under 30 in 2020, with the goal of assisting blockchain startup companies in reaching their full potential by providing hands-on supervision during the pre-seed and seed phases.

On August 18th, 2022, Shima Capital announced that it has raised $200 million for its first fund called Shima Capital Fund I and each firm will receive checks ranging from $500,000 to $2 million.

The VC’s first fund plans to support startups’ founders in the recruitment of talent, the creation of communities, and the promotion of the acceleration of technological R&D. Well-known blockchain founders and influencers including Andrew Yang, hedge fund billionaire Bill Ackman, metaverse venture capital Animoca Brands, and Dragonfly Capital were among the Fund’s backers.

Shima has a diverse portfolio of investments, including those in infrastructure, Defi, metaverse, and blockchain-based games. Shima appears to be profiting from all the blockchain projects they are funding, two of which are Highstreet, a play-to-earn (P2E) metaverse that brings physical shopping to the world of video games, with a ROI index of +440.5%, and Bloktopia, a metaverse project that aims to be a hub for education and entertainment for cryptocurrency users of all levels, with a ROI index of +1,809.7% since the private sale.

Risks in venture capital investment

Risks posed by blockchain project

Not all metaverse venture capitalists that invest in businesses or startups with a focus on gaming or metaverse infrastructure will be 100% successful and generate enormous profits. Since the name “venture capital” itself implies the element of risk, there will always be a probability of failure in the beginning.

People are all aware that blockchain, which is a computing platform, and the metaverse are both relatively new ideas, and it will take time for metaverse-focused businesses to work efficiently and grab the chance to be successful in the future. This demonstrates the need for a thorough and in-depth assessment of a crypto project by the metaverse investors.

The collapse of the Terra ecosystem has been one of the hottest topics among cryptocurrency investors. The Luna’ crash caused the cryptocurrency fund Three Arrows Capital (3AC) to suffer significant losses of more than $200 million and over $3 billion of dollars from Hashed VC, despite the fact that many investors considered Terra as a secure staking platform.

All the metaverse venture capital firms that DarePlay has mentioned above have been quite successful in the metaverse investment sector. However, there are other metaverse projects like Metastrike (invested by Shima Capital) that are not “money-makers” since its token, MTS, has gradually lost value.

Risks posed by venture capital firm

The importance of a metaverse venture capital to a blockchain project cannot be underestimated. A metaverse project’s success or failure depends not only on the internal development team, but also on venture capitalists’ assistance for technical, financial, or operational problems of the project.

The phenomenon in which tokens are rushed out by VCs is the particular example that DarePlay wants to bring out. Angel investors who invest in a cryptocurrency project typically pay less for the native token before it is listed on cryptocurrency exchanges. In case the metaverse venture capital decides to sell all of the tokens at once, not only will the token’s price crash, negatively affecting the project’s operation but individual investors also experience huge losses.

Both metaverse venture capitalist and the invested company must be consistent in the project’s path of development to achieve greater goals.

Conclusion

The metaverse has already generated excitement among tech enthusiasts and businesses all around the world. Whether or not the metaverse will happen in the near future and allow the interactivity among people is still up in the air. However, it is obvious that it has the potential to disrupt metaverse venture capital companies by pushing them to invest more money in technology to offer consumers metaverse experiences. Follow dareplay.io for more upcoming interesting articles about metaverse, gamefi and NFTs.

Tiếng Việt

Tiếng Việt

Related Posts

The metaverse definition – All you need to know about the metaverse

A Grand View On The Mainstream Metaverse Game Industry

A Broad View Of The GameFi Industry And New NFT Games

Top 5 Best Metaverse Games In The Market You Should Not Miss Out On

Top 7 amazing Free-to play NFT games you shouldn’t miss in 2022

Are Metaverse Land Sales a Good Strategy for Metaverse projects?